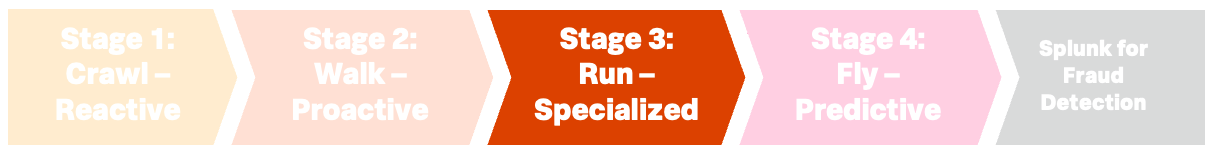

Mapping your organization's fraud detection maturity

Fraud in the financial services industry is an ever-evolving threat, demanding a dynamic and adaptive defense. Organizations often start by implementing reactive measures, but the journey to robust fraud detection ultimately progresses to proactive, AI-driven predictive analytics.

By analyzing how different organizations tackle fraud, a distinct process maturity model emerges, characterized by the capabilities, Splunk products, and use cases they leverage. This article explains each stage of this maturity model and explains how you can use the powerful suite of Splunk products to achieve higher stages of maturity.

By using the information in this article, you can:

- Self-assess your current state: Identify your current fraud detection maturity stage.

- Define your future goals: Set clear objectives for advancing your fraud detection capabilities.

- Plan your Splunk product adoption: Strategically decide which Splunk products to implement next.

- Implement specific use cases: Apply the provided examples directly to your fraud detection efforts.

- Allocate resources: Plan for necessary data sources, integrations, and skill development.

- Build business cases: Justify investments in Splunk solutions for fraud prevention to stakeholders.

- Guide continuous improvement: Use the framework to systematically evolve your fraud detection program over time.

Mapping your maturity

The visual above shows the stages of fraud detection maturity model with the activities and Splunk products that are progressively integrated as financial services organizations advance their fraud detection capabilities.

In the following sections, we'll walk through each maturity stage, showing how Splunk products transform fraud detection from simple reactive measures into sophisticated AI/ML-driven predictions that minimize losses and protect operations.

Stage 1: Basic search and reactive detection (Crawl - Reactive)

At this stage, your primary focus is on centralizing data to investigate known fraud incidents. Detection is typically reactive, often triggered by external reports or simple, static alerts. The immediate goal is to gain visibility into events and respond to threats as they emerge.

Fraud detection maturity at this stage:

- You are collecting and ingesting basic data from various sources, such as transaction logs, authentication systems, and web logs.

- You perform manual, ad-hoc searches to investigate specific incidents.

- You use simple reports and dashboards for basic visualization of events.

- Your response to fraud occurs after an incident has been confirmed.

Splunk products utilized:

- Splunk platform: The Splunk platform ingests, processes, and analyzes large volumes of diverse machine data in real-time. It provides the core capabilities for searching, reporting, and creating custom dashboards and alerts based on static thresholds.

- Splunk Solution Accelerator for Fraud Detection: This accelerator provides pre-built content, dashboards, and reports to jumpstart fraud detection efforts within the Splunk platform, offering foundational insights and speeding up initial deployments.

Example use cases:

- Searching for specific transaction IDs or IP addresses linked to a reported fraudulent activity.

- Creating a dashboard to monitor daily login attempts or transaction volumes.

- Identifying patterns in historical data after a fraud event has been confirmed.

Stage 2: Rule-based and proactive monitoring (Walk - Proactive)

As you mature, you move beyond purely reactive measures. This stage involves implementing predefined rules and correlation searches to proactively identify suspicious activities. The focus shifts to continuous monitoring and generating alerts for known fraud patterns, often integrating security context to improve detection accuracy.

Fraud detection maturity at this stage:

- You implement predefined rules and correlation searches to detect known fraud patterns.

- You establish continuous monitoring of critical systems and transactions.

- You generate alerts for suspicious activities based on established thresholds and logic.

- You begin integrating security information to provide richer context to fraud events.

Splunk products utilized:

- Splunk platform: Continues to serve as the data foundation, while enabling more complex correlation searches across disparate data sources.

- Splunk Enterprise Security (ES): This Security Information and Event Management (SIEM) solution extends the Splunk platform with advanced security monitoring capabilities. For fraud, ES enables sophisticated correlation searches, risk-based alerting (RBA), and a structured incident review workflow to improve alert fidelity and reduce false positives.

Example use cases:

- Detecting multiple failed login attempts followed by a successful login from a new or unusual IP address.

- Monitoring for "velocity" use cases, such as numerous accounts created from a single IP address or device.

- Correlating transaction data with authentication logs to identify potentially compromised accounts.

Stage 3: Specialized fraud analytics and behavioral insights (Run - Specialized)

At this advanced stage, you leverage specialized applications and behavioral analytics to detect more sophisticated fraud schemes. The emphasis is on understanding user behavior, identifying anomalies, and using risk scoring to prioritize investigations, moving towards a more predictive and intelligent approach.

Fraud detection maturity at this stage:

- You utilize specialized fraud applications with pre-built use cases such as the Splunk App for Fraud Analytics (SFA).

- You implement User and Entity Behavior Analytics (UEBA) to detect anomalies in user and entity behavior.

- You employ risk scoring to effectively prioritize and manage fraud alerts.

- You focus on specific fraud types like new account fraud and account takeover.

Splunk products utilized:

- Splunk Enterprise Security (ES): Provides the underlying framework for risk-based alerting and incident management.

- Splunk App for Fraud Analytics (SFA): This dedicated app, built on Splunk ES, offers out-of-the-box correlation searches, data models, and dashboards for specific fraud use cases, such as new account fraud and account takeover. It streamlines workflows and leverages advanced analytics to identify complex patterns.

- Splunk User and Entity Behavior Analytics Splunk User Behavior Analytics (UEBA): UEBA uses behavior-based anomaly detection and machine learning to detect subtle deviations in user and entity behavior, enabling early identification and neutralization of insider threats such as account misuse, compromised credentials, and lateral movement.

Example use cases:

- Detecting account takeover by flagging unusual login locations, access times, or interaction patterns for a specific user.

- Identifying new account fraud by correlating data points like phone numbers, IP addresses, and bank account details during account creation.

- Monitoring for financial fraud using behavioral profiling to spot deviations from established norms.

Stage 4: AI/ML-driven anomaly detection and predictive analytics (Fly - Predictive)

This is the highest stage of fraud detection maturity. Here, organizations use machine learning (ML) and artificial intelligence (AI) to detect subtle anomalies, predict emerging fraud patterns, and continuously refine their detection accuracy. This stage involves building custom ML models and leveraging advanced statistical techniques for proactive and adaptive fraud prevention.

Fraud detection maturity at this stage:

- You build and deploy custom machine learning models for anomaly detection and predictive analytics.

- You continuously improve detection accuracy through adaptive thresholds and AI-driven insights.

- You leverage advanced statistical methods (for example Benford's Law or Zipf's Law) for fraud pattern identification.

- You integrate with large language models (LLMs) for enhanced analysis and simplified investigations.

Splunk products utilized:

- Splunk Enterprise Security & Splunk UEBA: These continue to provide a robust platform for alert generation, risk scoring, and behavioral context.

- Splunk App for Fraud Analytics: Can be further enhanced with custom ML models developed using AITK to address more unique and evolving fraud scenarios.

- Splunk AI Toolkit (AITK): This toolkit provides the capabilities to build, train, and deploy machine learning models directly within the Splunk platform. You can apply advanced analytics for anomaly detection, predictive modeling, and identifying evolving fraud trends. Recent updates to AITK also allow for integration with LLMs to automate complex analysis and streamline detection workflows.

- Splunk MCP Server: The Splunk Model Context Protocol (MCP) server provides a standardized, secure, and scalable interface to connect AI assistants, agents, and other intelligent systems with data in the Splunk platform for both Splunk Enterprise and Splunk Cloud Platform customers in beta.

Example use cases:

- Using ML models to predict the probability of a transaction being fraudulent in real-time, enabling proactive blocking or review.

- Automatically detecting outliers in risk scores using the Smart Outlier Detection Assistant to uncover previously unknown fraud schemes.

- Leveraging AI to simplify complex fraud investigations, allowing non-technical users to query data and receive actionable insights.

Next steps

By strategically navigating this maturity curve, FSI organizations can use the powerful Splunk platform and specialized products to construct a robust and adaptive fraud detection program. This progression moves you from simply reacting to threats to intelligently predicting and preventing them, securing your assets and maintaining customer trust.

Check Splunk Lantern's complete FSI use case library for use cases that correspond to your current stage of maturity and the stages of maturity you're seeking in future. To explore other use cases, use the Splunk Essentials for the Financial Services Industry app to automate searches to detect financial crime. The app also provides more insight on how searches can be applied in your environment, how they work, the difficulty stage, and what data can be valuable to run them successfully.

If you have questions about monitoring for account takeover in your environment, you can reach out to your Splunk account team or representative for comprehensive advice and assistance. You can contact your account team through the contact us page.

For more in-depth support, consult Splunk OnDemand Services to access credit-based services for direct access to Splunk technical consultants with a variety of technical services from a pre-defined catalog. Most customers have OnDemand Services per their Success Plan. Engage the ODS team at ondemand@cisco.com if you would like assistance.